MSP Valuation Craziness...

Mar 03, 2022I can’t tell if this is a joke or not - but let me run something past you.

I have an MSP for sale. It’s a $750k turnover, and about a $50k Net profit.

What would you pay for it?

$50k?

$100k?

$500k?

$1m?

I would put money on the fact, that none of you... none of you would have guessed $3m!

Which is apparently, exactly what the owner of this MSP is after.

$3m.

For a company that nets a $50k profit each year.

$3m.

Errrmmmmmm.

I don't normally do posts like this, but after seeing this it stuck out like a sore thumb and I just knew I had to talk about it. Hopefully, after reading this you won't be the guy who grossly over values his business but more importantly, you won't be the sucker willing to pay $3 million for a business that in its current state, would take you 60 YEARS to get back what you paid in.

SET SOME EXPECTATIONS

There are many ways of valuing a business. There are also many ways of not valuing your business. Like someone using ‘projected future earnings’ as a way to bump up the sale price.

Typically speaking - with a company doing $750k in revenue, with a $50k net profit, you could strip out some of the owner's costs, and maybe that could be $100k or $150k profit. Well, at least now we’re down to about 40 years.

Without knowing the inner workings of said IT business, I would hazard a guess, that a suitable value for that MSP would be in the region of $400 to $800k.

Waaaay less than $3m.

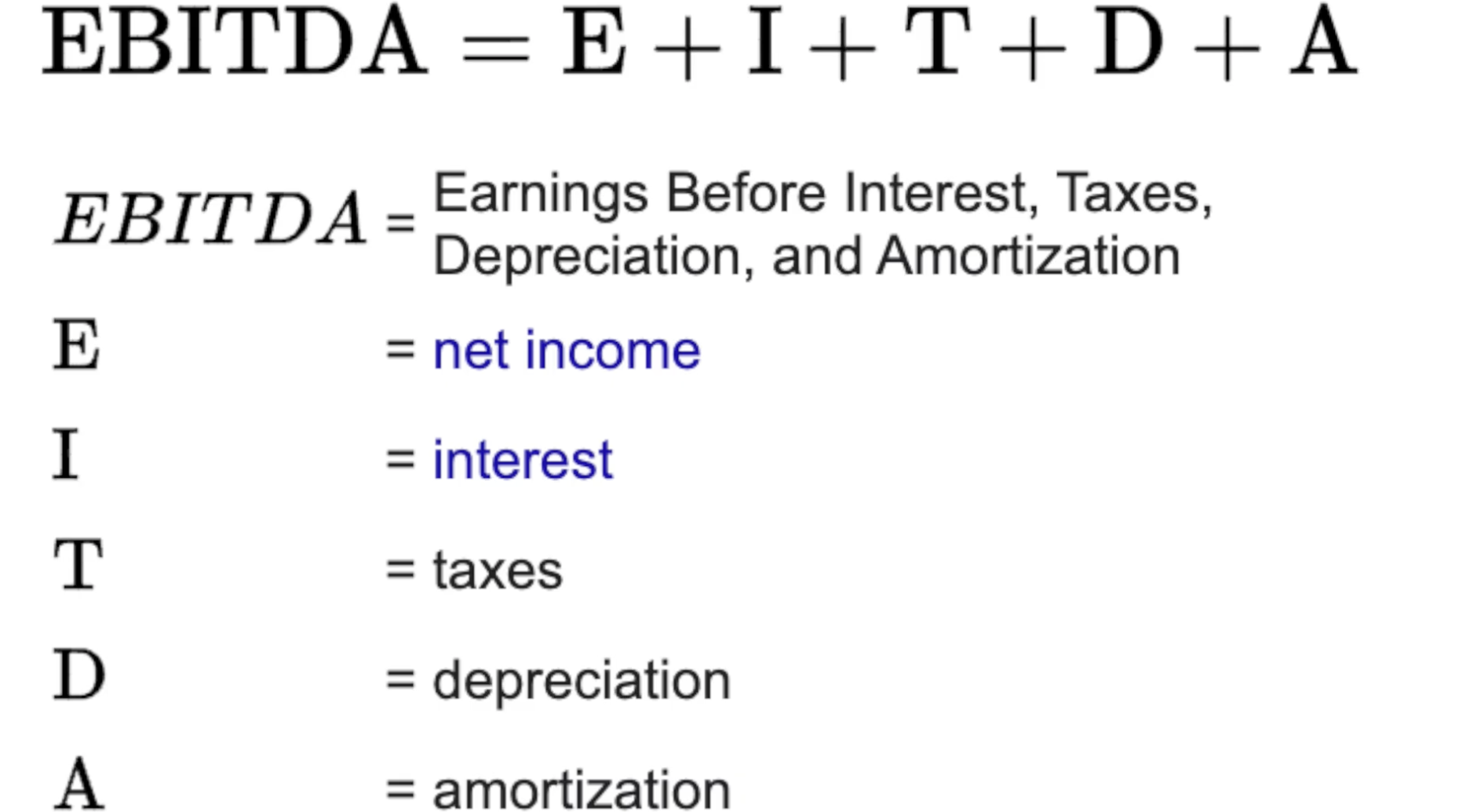

From my own experience from selling my own MSP, and from helping a number of other people sell their IT businesses, the valuation typically starts with one number. The EBITDA.

Earnings before income tax depreciation and amortisation. I know, it's a mouthful.

Basically, it’s a figure you can pull from your accounts system.

You take the EBITDA, and you multiply that by something, and that something is what you negotiate on with prospective buyers.

For businesses under $1m in revenue, it could be a 2-4x multiple.

For businesses over $1m it could be a 4-7x multiple, and if you’re over $6 or $7m, then you could be looking at anywhere from 7 to 11 multiples.

So you can see why a lot of people are keen to grow by acquisition. You buy up a bunch of smaller businesses, group them all together, command a higher multiple, and then sell them all together!

This is something you have to be really careful of when looking to sell your business. Those who are just looking to eat you up, absorb you, just to fatten them up so they can sell themselves again shortly after. The people who probably care less about the actual service they provide, focusing instead on how they can fatten their EBITDA number, along with getting a higher multiple.

So if you are thinking about selling your business, figure out your EBITDA.

Start with the lower end of the multiples, and then you can add more multiples for things like having solid processes in place if the business functions without you in it; if you have sticky customers who never leave you; if you’re super profitable - there are lots of reasons and ways to get that multiple up.

What I will say is that here in the MSP world, we are definitely seeing higher valuations than we were a few years ago. If anything, Covid seems to have really brought around a tonne of mergers and acquisitions, so if you are considering selling - then right now might not actually be a bad time to get the best bang for your buck.

Back to your regularly scheduled programming next week!

If you enjoy posts about tech and MSP-related business, why not consider heading over to my YouTube channel where you can subscribe for regular videos.

💌 Sign up for the weekly newsletter: https://www.notabusinesscoach.com/

This. But in your Inbox!

Get the latest Blogs, Resources, Templates and Courses straight to your Inbox.

We hate SPAM. We will never sell your information, for any reason.